Get a Car Title Loan

Serviced by LoanMart Today

Past Bankruptcies and Bad Credit are okay1

Call before Noon, Have Your Cash Today3

Use your car title to unlock your cash!

Past Bankruptcies and Bad Credit are okay1

Call before Noon, Have Your Cash Today3

Use your car title to unlock your cash!

3 Easy Steps to Apply for Fast Title Loans Online or Near You!

Click or Call

The loan process is extremely fast and hassle-free. Apply over the phone or online in 30 minutes or less!3

Submit Info

Submit your documents by 2 pm PT, get your cash the same day3. With a qualifying vehicle and steady income, you could find yourself with a competitive loan offer!1

Get Your Money!

Get money sent directly to your bank account, or pick up your money at a participating location.

Instant Phone Decision1 • Any Car, Any Year • High Approval Rates

What is a Car Title Loan Serviced by LoanMart?

With a car title loan serviced by LoanMart, you are using your vehicle as collateral to get a loan.¹ Essentially, you are accessing your car's equity to solve your financial problem! As a secured loan option, car title loans can offer qualified borrowers a flexible approval process and a faster way to get cash.³

Title Loan Benefits

You Can Get Today.

Fast Cash

Get your title loan

approved in minutes.1

Competitive Interest Rates1

Competitive rates, flexible loan terms and affordable monthly payments.1

Keep Your Car

You get to keep driving

your car with the cash you need.

Don't Pay Too Much for your Auto Title Loan

Use your car to get cash and keep driving it when you apply for a Title Loan.

Whether you prefer short-term loans or long-term loans, you have options! Here at LoanMart, we care about our customer's financial relief with payments that are manageable. LoanMart gives you the option to repay your loan early, without any prepayment penalties!

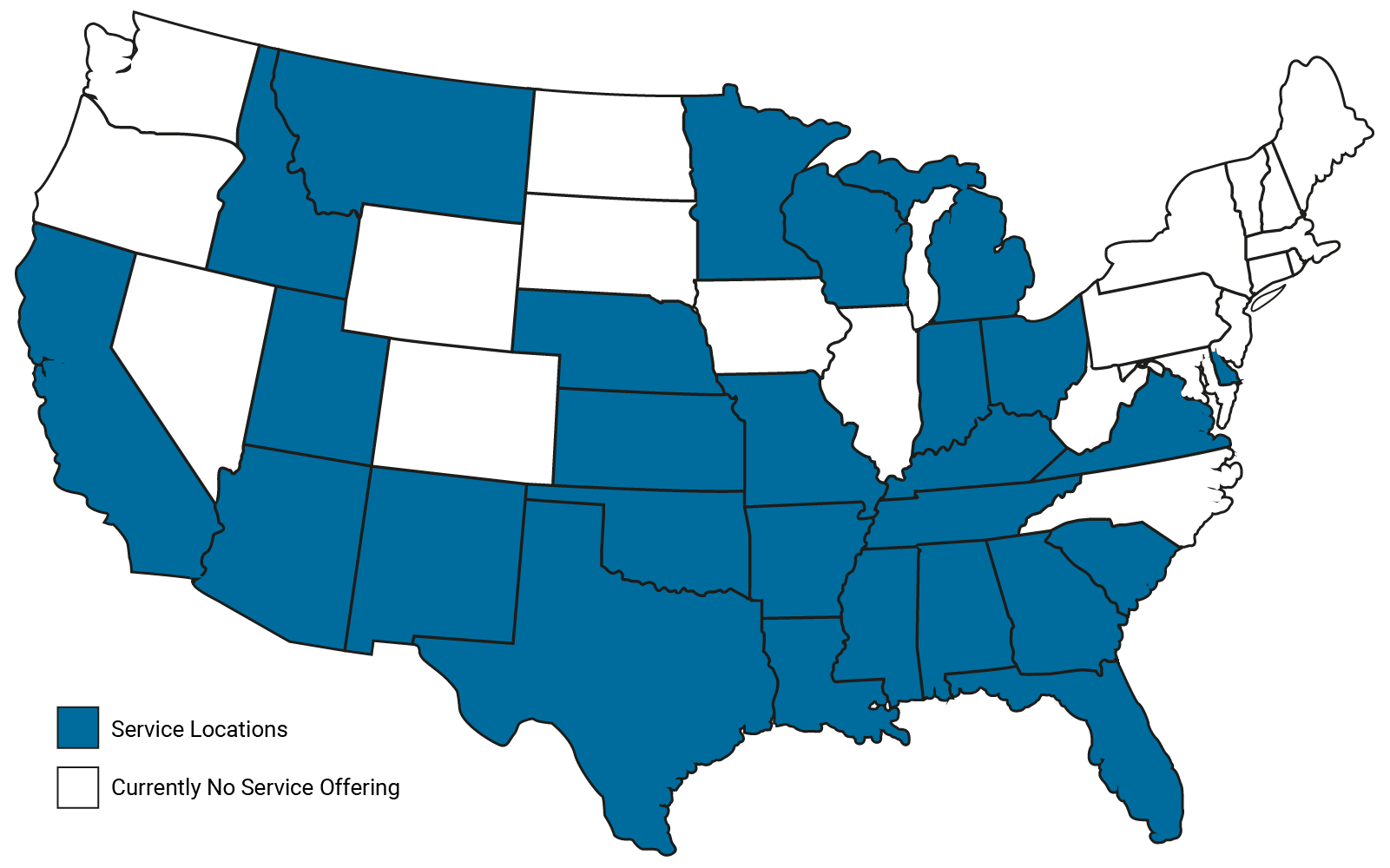

Title Loan Services Near Your Home

Learn more about the various Title Loan Services and Cash Options near you.

1,300+

Metropolitan Areas Served

30+

States Served

250,000+2

Customers Helped

Why Choose LoanMart?

Facing a financial emergency alone can be tough. When life happens unexpectedly, finding the right lender can be a key to come out ahead. Choosing the right loan option for your finances can give yourself the chance to get back on your feet.

Here at LoanMart, providing trusted and quality service to our customers has been our business and our reputation for over 10 years. You can expect customer service agents that care enough to be available outside of normal business hours, six days a week. Our whole team is committed to making your experience with LoanMart convenient! While the approval process is online, real people are waiting to take your call today at 855-422-7412.

Apply for a Title Loan Online Today

While many loan options exist online, they may not be the best choice for your finances in the long run. Payday loans can come with very high interest rates, credit cards can come with low limits for cash advances, and personal loans are often only available to borrowers with strong credit histories. If you need fast financial relief, the key is through your car's keys! Use your car's title to get access to cash you need - even if your financial history isn't perfect. Keep driving your car while you make on-time payments to your loan.¹

Get started on your loan today by filling out our online form! The process to get a car title loan is meant to be streamlined through LoanMart. Financial emergencies happen unexpectedly, and you need a loan that can keep up with your time constraints. Approved borrowers can get their cash in as little as one business day after approval!³