How Do I Get Emergency Money Through a Title Loan in Durham, North Carolina?

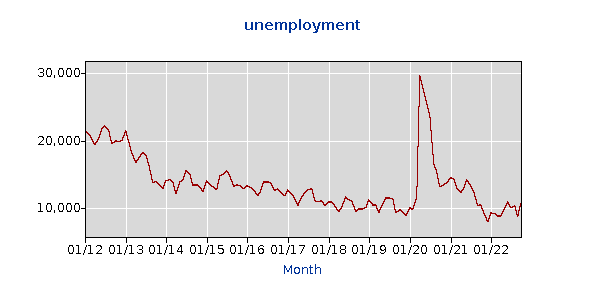

Has an unexpected bill or expense thrown you for a loop? If you are one of the 8,800 people who are unemployed in Durham, North Carolina, you may be struggling with your finances. Thankfully, you could use your car as collateral to get a title loan and receive quick funds to cover your unexpected expenses. Since collateral is used to secure the funds, the approval process could be much more flexible for people with poor credit who may not qualify for traditional loans.1

Be aware that these two factors matter the most when applying for an auto title loan in Durham, North Carolina:

- The Value of Your Car

- Your Ability to Repay the Loan

The approval process for a collateral-based loan can be flexible. However, because the vehicle title is used as collateral for the loan, the lender can repossess your car to help cover the remainder of your debt if you default on the loan.

A lender will place a lien on your title until you finish your monthly installments. Once the loan is paid off, the lender will remove the lien.1 As long as you make your monthly payments on time, you will maintain access to your vehicle during the repayment process.

What if you don’t know your vehicle’s current value? That’s okay! An online calculator tool is available for title loan borrowers to quickly obtain an estimate with a no-obligation quote. Simply input some information about your car to use the online tool.

Contact a LoanMart title loan agent at 855-422-7412 to determine if you have enough value to qualify for an online title loan near you. Qualified borrowers could receive their emergency cash in as little as 24 hours! 1 3

Is a Credit Check Required to Apply for Title Loans in Durham, North Carolina?

With a title loan serviced by LoanMart, your credit history is not the center of the approval process, although it is still considered. If you agree to proceed with the loan agreement, your credit will go through a hard inquiry check. The credit check may affect your credit score by a few points.

As long as you have a title to a qualifying vehicle in your name and proof of income, you could be eligible for an auto title loan in Durham, North Carolina. Contact a title loan representative from LoanMart at 855-422-7412 to see how you can get car title loans even if your credit is not perfect!1

What’s the Most I Can Borrow Through an Auto Title Loan in Durham, North Carolina?

The amount of money you can borrow through an auto title loan will largely depend on your income and the value of your car. The more positive equity your vehicle has, the more funding you could potentially receive! But that’s only possible if you have the income to support that loan amount.1

With most online title loans, the average amount you could access is up to 50% of your vehicle’s equity. That means you could get anywhere between $1,000-$10,000! But it’s important to keep your car in good condition and meet the right criteria to qualify for the money you need for a financial emergency.1

How Can I Qualify for a Car Title Loan in North Carolina?

While other types of loans can be difficult to qualify for, an auto title loan can be comparatively easy to obtain. You would only need to meet the following initial requirements to see if you can acquire funding through a title loan in Durham, North Carolina:1

- Possess a Vehicle Title in Your Name

- Have a Qualifying Car with Enough Positive Equity

- Be Able to Provide Proof of Steady or Alternative Income

- Be 18 Years of Age or Older to Apply

In addition to meeting these initial requirements, you will need to submit a few documents:

- Bank Statements, Pay Stubs, or Another Document to Prove Your Income

- Recent Utility Bills, Credit Card Statements, or Rental / Lease Agreements to Prove Your Address

- A Car Title in Your Name

- Recent Photos of the Vehicle

- A Driver’s License, Passport, or Another Valid Government / State-Issued ID

With LoanMart, these documents can be conveniently submitted online during your title loan inquiry!

If you’re dealing with a tough financial situation, don’t hesitate to apply for the aid you need through a title loan serviced by LoanMart. If you meet the initial qualifications and submit the right documents, you could receive quick funding in as little as one business day!1 3

Where Can I Apply for Auto Title Loans Near Me in Durham, North Carolina?

Now that you have learned plenty about car title loans in Durham, North Carolina, it’s time to find out where to apply! Fortunately, with an auto title loan serviced by LoanMart, you can conveniently apply from the comfort of your home. Use your smartphone, computer, or tablet to get started on your inquiry today. 1

If you are a Durham resident that needs financial relief, you can take advantage of the quick, three-step process to get money in a flash:1 3

- Submit a Short Title Loan Inquiry Online, or Over the Phone with a Title Loan Agent

- Submit a Few Required Documents to Verify Your Information

- Get Your Cash if You Qualify!1

You can choose between a few different ways to receive your money if you obtain loan approval:

- Direct Deposit to Your Bank Account

- Get a Check Sent to Your Durham Residence

- Pick Up Your Money at a Participating Money Transfer Location Nearby

Go online or dial 855-422-7412 to start the approval process for a car title loan serviced by LoanMart in Durham, North Carolina. You could get the money you need in as little as 24 hours if you qualify!3