How Do Title Loans Work in Wilmington, North Carolina?

Title loans in Wilmington, North Carolina, work by allowing an applicant to pledge the title of their vehicle as collateral for the loan. The title lender will offer a qualified borrower a loan amount based on their income and a percentage of their vehicle’s value. Typically, borrowers can access 25%-50% of their car’s value through a title loan. If the borrower is approved, they will sign a loan agreement, and their car’s title will have a lien placed on it. The lien is the title lender’s legal right to the asset until the loan is paid in full.

If you are like most North Carolina residents, your car is important to you. So naturally, you might be worried about what happens to your car after you sign a title loan agreement. Your vehicle can remain in your possession if you make your loan payments on time each month.

Use the title of your car, truck, or other vehicle to unlock your money today! You can apply online for auto title loans serviced by LoanMart in Wilmington, North Carolina. Or, dial 855-422-7412 to speak with a title loan representative. Title loan agents are available six days a week to walk you through the approval process! If you qualify, you could get your cash in as little as one business day.1 3

What Do I Need to Get Car Title Loans in Wilmington, North Carolina?

Getting online title loans in Wilmington, North Carolina, can be simpler than you think! You will only need to meet a few initial requirements to qualify for emergency cash.1

Auto title loans are flexible because they are secured by the borrower’s vehicle. But, there are initial qualifications that every borrower must meet to move forward with their application.1

If you meet all the criteria for a title loan serviced by LoanMart, you could receive funding in as little as one business day! Contact a title loan agent today at 855-422-7412 if you have questions about the title loan requirements.1 3

What are the Requirements for Auto Title Loans in Wilmington, North Carolina?

You do not need a perfect credit score to apply for an online title loan in North Carolina. Since collateral is used to secure the funding, the approval process can be much more flexible, even if you have a poor credit history.1

To get approval for an auto title loan, you must meet these initial requirements:1

- Demonstrate Ability to Repay the Car Title Loan

- Have a Car Title in Your Name

- Possess a Qualifying Car with Positive Equity

- Be at Least 18 Years of Age or Older

The initial qualifications for a title loan are simple to understand! If you’re struggling with an unexpected expense, don’t hesitate to apply for the financial assistance you need through an auto title loan! It can take no time at all to find out if you qualify for a title loan serviced by LoanMart.1 3

Can I Apply for a Car Title Loan Online in Wilmington, North Carolina?

Yes, you can apply for a car title loan online! With car title loans serviced by LoanMart, you don’t have to leave your home to apply for funding. You could easily apply for a title loan with your smartphone, tablet, or computer. No need to waste time driving around Wilmington when you have a pre-approval form waiting for you online!1 3

When you apply for an online title loan serviced by LoanMart, you can expect a flexible and convenient approval process. Take a closer look at the three simple steps you will go through:1

- Apply for a Title Loan Online by Submitting a Quick Form or Call a Loan Agent at 855-422-7412

- Submit a Few Documents Online to Verify Your Information, Vehicle, and Address

- Claim Your Cash if You are Approved!1

You can choose between a few different ways to get your money if you qualify for funding:

- A Direct Deposit to Your Bank Account

- Have a Check Sent to Your Residence

- Or Pick Up Your Funds at Any Participating Money Transfer Location Nearby

Ready to see if your vehicle qualifies for the cash you need in North Carolina? Take advantage of a quick and flexible approval process with LoanMart today! Apply online and find out how much money you can potentially qualify for within minutes.1 3

What Documents Do I Need to Apply for a Title Loan in North Carolina?

To qualify for a car title loan in North Carolina, you must submit a few documents. The paperwork is used to verify your information.3

You can expect to need the following documents when applying for an auto title loan online in Wilmington, North Carolina:

- A Driver’s License, Passport, or Another Valid, Government / State-Issued Photo I.D.

- Recent and Clear Photos of Your Car

- Bank Statements, Pay Stubs, or Another Document to Prove Your Income

- Recent Phone Bills, Rental/Lease Agreements, or Utility Bills to Prove Your Address

- A Vehicle Title in Your Name

- Some Personal or Professional References

Just submit your documents via email or fax! Applying for online title loans in Wilmington, North Carolina, can be that simple and convenient.

Can I Get Title Loans in North Carolina Without a Job?

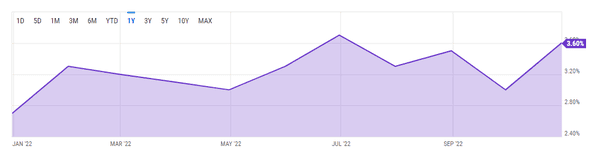

Unfortunately, you cannot apply for an online title loan without proof of income. According to recent data, 3.6% of people are unemployed in Wilmington, North Carolina. The income requirement for an auto title loan in North Carolina can feel unfair and inconvenient if you are in that percentage.

However, while proof of income is required, it doesn’t have to come from a traditional career. Just present proof of an alternative source of income to show that you can afford to repay a car title loan.1

Some alternative forms of income you could use for this requirement include:

- Social Security/Supplemental Security Income

- Worker’s Compensation

- Pension Income

- Settlement Income

- Retirement Income

Any questions? Don’t hesitate to contact a title loan representative with LoanMart at 855-422-7412! If you have an alternative source of income, you could still qualify for the funds you need for an unexpected bill or expense!1

How Much Can I Borrow with a Car Title Loan in Wilmington, North Carolina?

Wilmington residents can access up to 50% of their vehicle’s value through a car title loan if they are approved. That means they can likely borrow anywhere from $1,000 to $10,000! Keep in mind that you’ll have to repay the loan amount plus interest once you sign your loan agreement.1

It’s essential to note that the more value your car has, the more significant your loan amount could be! However, you will only be able to access a larger loan amount if you have the income to support it. With Wilmington car title loans, you could access your vehicle’s equity and turn it into the cash you need.

What if you don’t know your car’s current value? That’s fine! LoanMart’s online calculator tool allows applicants to obtain a car value estimate with a quote, free of obligation. Just provide some information about your vehicle to use the calculator tool.

Apply for an Auto Title Loan in Wilmington, North Carolina

Get the funds you need for an emergency by applying for a North Carolina title loan! You can begin the approval process by filling out a brief online pre-approval form. Or, get started by calling a title loan agent from LoanMart at 855-422-7412. Wilmington applicants can retrieve money in as little as 24 hours if they qualify for a car title loan serviced by LoanMart!1 3