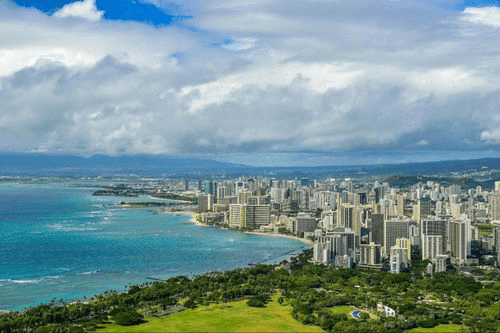

What are Title Loans in Honolulu?

Do you need fast cash? Online title loans in Honolulu can be a convenient and flexible option to get the money you need for a financial emergency. Through a vehicle-secured personal loan, you can borrow against the value of your car! Since you’re required to use your car’s title as collateral for the loan, you don’t need a perfect credit score to qualify for the money you need.1

If you’re eligible for an auto title loan, you can sign your loan contract and choose how to get your money. The next step is that a lender will add a lien on your vehicle’s title after the loan is funded. One of the perks of title loans is that you can still drive your vehicle while you make on-time payments on your loan!

Residents of Honolulu, Pearl City, or other areas in Oahu can conveniently apply for a title loan online. To qualify for this vehicle-secured loan, you must be at least 18 years of age, have a car with a sufficient amount of equity, and provide the following documents to verify your information:

- A Vehicle Title in Your Name to Prove Ownership

- Valid, Government-Issued Photo ID, Like a Driver’s License or U.S. Passport

- Proof of Income, Such as a Bank Statement or Recent Pay Stub

- Utility Bills, Credit Card Statements, or Phone Bills to Verify Your Address

- Recent Photos of Your Car to Complete a Virtual Inspection

When applying for auto title loans in Honolulu, you can upload the required paperwork online or send them directly to a LoanMart title loan officer via email or text message. If you qualify for funding, you can expect to access competitive interest rates and receive quick cash in as little as 24 hours!3

Dial 855-422-7412 to learn more about applying for a secured loan with a car title. Title loan representatives are available six days a week for extended hours to answer your questions, like “What if I don’t qualify for an auto title loan?”

How Can I Apply for Online Title Loans in Honolulu, HI?

Instead of applying for a car-secured personal loan in person at a loan store, you can take advantage of an online application process! Through auto title loans in Honolulu serviced by LoanMart, you can expect simplicity and convenience at every step. Take a closer look at the steps listed below to apply for emergency funding:1

- Choose How to Begin Your Loan Request: Start your application for a car title loan in Honolulu by completing a short online questionnaire or by calling a loan officer at 855-422-7412. If you choose to begin your title loan request online, you can instantly find out if you’re prequalified for fast cash!

- Submit Your Paperwork: As mentioned above, you will be asked to submit documentation to verify your income and other pertinent information after you receive initial approval for a title loan. During the second step of your application, you can work closely with a title loan agent to discuss the different items included in your loan contract, including your loan terms, loan amount, and interest rate.

- Get Your Money: If you’re fully approved for an online title loan in Hawaii, you can choose to receive your funds via direct deposit and sign your loan agreement! There are other convenient ways to receive your cash after final approval, such as getting a check in the mail or picking up your funds at a participating money transfer location in Honolulu.

If you’re eligible for a title loan serviced by LoanMart, you can get your money as soon as the next business day!3 So why wait to see if you qualify for fast financial help? Apply online today by submitting a brief prequalification form or by calling the toll-free number!

What are Two Disadvantages of Car Title Loans in Honolulu?

Car title loans in Honolulu, Hawaii, may have some potential drawbacks. Fortunately, you can work to avoid these possible risks by staying on top of your title loan payments! Take a look at two potential disadvantages associated with getting an online title loan:

- Potential Vehicle Repossession: Title lenders can repossess a borrower’s vehicle if they miss their payments and default on their loan. If you need your car to commute to work, losing your vehicle can be incredibly inconvenient and frustrating. However, many title loan lenders are willing to work with you to arrange an alternative solution. If your loan installments become unmanageable, it’s important to speak with your lender or loan servicer about your financial issues before you default on your loan.

- Reduced Credit Score: Defaulting on a car-secured personal loan can negatively impact your credit score if your title lender or servicer reports your payment behavior to one of three credit bureaus: TransUnion, Equifax, and Experian. To avoid that potential consequence, you must be on time with your title loan payments and communicate with your lender or servicer if you face any issues during the repayment process.

What are the Benefits of Auto Title Loans in Honolulu Serviced by LoanMart?

Eligible applicants in Honolulu can experience many valuable benefits when they apply for auto title loans serviced by LoanMart! Take a closer look at some of the advantages you can expect when qualifying for this vehicle-secured loan option:1

- A Flexible and Quick Application Process

- No Hidden Fees5

- Competitive Interest Rates

- Several Repayment Methods

- Fast Funding

- Excellent Customer Service

- Zero Prepayment Penalties5

Get started on your loan application by filling out a short pre-approval form online, or call the toll-free number to reach a LoanMart title loan officer. If you’re eligible for car title loans in Honolulu, Hawaii, you can get emergency cash in as little as one business day!3

FAQs About Title Loans in Honolulu, Hawaii

Access all the information you need about Honolulu title loans before you start the application process. Listed below are answers to a few frequently asked questions about vehicle-secured personal loans:

What is the Minimum Credit Score for a Title Loan in Honolulu?

The credit requirements for a title loan will differ depending on the lender you work with, so it’s difficult to pinpoint the minimum score to qualify for a title loan. Some lenders do not have any minimum credit score requirements. But keep in mind that car title loans are known for their flexible credit criteria, which means you can still apply for funding even if you have a bad credit score! Call 855-422-7412 to learn more about how you can apply for bad credit title loans in Honolulu online.1

How Much Can You Get Through Online Title Loans in Honolulu?

The amount of cash you can receive through a title loan will generally depend on the value of your car or truck and your ability to make a payment on your loan. Depending on those two factors, you can potentially access up to $15,000 if you’re eligible for an online title loan serviced by LoanMart in Honolulu!1

Can I Get an Auto Title Loan Without a Job?

You must prove your ability to make car title loan payments in order to qualify for a loan. However, you don’t need a specific type of job to get approved for a title loan in Honolulu. If you don’t have regular pay stubs to submit during your loan application, then you can provide proof of alternative income, like settlement income, retirement income, and workers’ compensation.

Addresses shown display closest MoneyGram locations. Map displays all MoneyGram locations in general vicinity.

Locations Near Honolulu, Hawaii

LoanMart is proud to help people all over the United States, including Honolulu, Hawaii and beyond! Look through the different LoanMart service areas and see which one is closest to your neighborhood: