How Do Title Loans Work?

If you plan on applying for fast funding through an auto title loan, you might be wondering, “How do title loans work?” Simply put, a title loan is a convenient loan option that allows applicants to use their vehicle title as collateral for the loan and obtain fast cash. Through a title loan, you can borrow against the value of your vehicle and use your loan proceeds to handle a plethora of financial issues.1 Typically, you will be able to access up to 50% of your vehicle’s value through a title loan if you meet the required criteria to obtain loan approval and can provide the necessary documents.1

Whether you are applying for a title loan online or at a storefront location, as soon as the loan is funded, the title lender will place a lien on your car’s title. The lien will remain on your vehicle’s title until you’ve completely repaid the loan. While you pay your title loan on time each month, you can continue to drive your car and have access to it during the repayment process. After your title loan is paid in full, the title lender will release the lien from your title, and it may take several business days to get your title back in the mail, depending on your state of residence.

It is important to prioritize your title loan payments each month. Although many title lenders prefer to avoid repossessing your vehicle, your asset could potentially be seized by the title lender if you default on your loan.

Do you have questions about how to get a title loan? Visit the FAQ page or call LoanMart at 855-422-7412 to learn more about how title loans work.1

Do I Need Good Credit to Apply for a Title Loan?

Without a strong credit history, you may find it difficult to qualify for an unsecured loan option like a personal loan. Since unsecured loans don’t require the applicant to use an asset as collateral in order to secure the loan, the applicant’s credit history will become the main focus of the loan application. If you have a poor credit score, many lenders will see you as a risk to lend money to, which is why it can be difficult for you to obtain loan approval for an unsecured loan.

However, with a car title loan, your credit score isn’t the primary focus of your application! Instead, these two factors will matter the most during your loan inquiry:1

- The Current Value of Your Vehicle

- Your Ability to Repay the Car Title Loan

These characteristics will predominately affect your loan amount and eligibility for a car title loan serviced by LoanMart. But what if you don’t know the current value of your vehicle? That’s okay! You can use LoanMart’s online title loan calculator to learn more about the value of your car or truck and get a loan quote with no obligation today!1 All you will need to do is enter the necessary details about your vehicle into the online form to receive an estimate in just a few minutes.3

How to Get a Title Loan Online?

Looking to learn more about how to get a title loan online? If you prefer the convenience of an online application, you might be asking yourself one important question: How do online title loans work? Applying for an online title loan can be straightforward and convenient, but you must meet a few initial requirements in order to obtain loan approval.1

Take a look at the application criteria you must meet to obtain an online auto title loan serviced by LoanMart:1

- Possess a Title to a Qualifying Car, Truck, or SUV in Your Name

- Be Able to Prove you Have Income Sufficient to Cover Your Monthly Title Loan Payments

- Be of Legal Age to Apply for a Title Loan in Your Current State of Residence

In addition to meeting these initial requirements, you will be asked to submit a few important documents in order to verify all of your information. Here is a list of the paperwork you must provide during your loan application:1

- A Car Title in Your Name

- Proof of Income

- Proof of Current Residence

- A Few References (Could be Professional, Personal, or Both)

- Valid, Government-Issued Photo ID

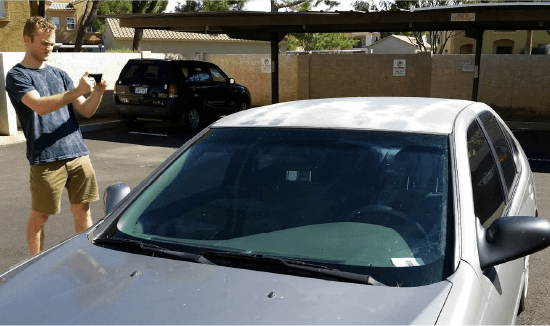

- Recent and Clear Images of Your Vehicle

If you do not want to upload your documents online, you can take advantage of other convenient submission methods by sending your documents to a LoanMart title loan agent through email or text message.

Your documents must be verified for completeness before you can move forward with your title loan approval. Once the documents have been verified, you will receive an electronic contract to review and sign. Keep in mind that you will be asked to send your vehicle title through the mail using a pre-paid label if you own your vehicle outright. However, that doesn’t mean you need to own your car outright to apply for a title loan! If you are still making payments on your car, you may need to complete a payoff authorization form so your new title loan lender can pay off your existing lender.

If you’re dealing with a difficult financial situation, don’t hesitate to apply for the emergency money you need through a car title loan serviced by LoanMart. If you meet the initial criteria and provide the correct documents, you can access fast cash, competitive interest rates, and zero hidden fees!1 5

How Do Title Pawns Work?

If you’re searching for a convenient way to access emergency cash, you may have heard of another loan option known as a title pawn.

Although a title pawn works similarly to a title loan and allows you to use your car as collateral for fast cash, they are not exactly the same. You can pawn your car title at a pawnshop with a pawnbroker or apply for a title pawn online with a title pawn lender. If you’re eligible for an auto title loan, you can retain access to your car throughout the duration of the loan, but you are required to keep up with your monthly payments. However, if you do not work with an online title pawn lender and choose to pawn your vehicle at a pawnshop, the pawnbroker will usually keep your car in their designated storage yard. The vehicle will remain in the storage yard while you continue to make payments on your loan, and you will not have any access to it until the loan is completely paid off.

If a title pawn does not sound like the right fit for you, consider applying for a title loan instead! Click here to apply for a title loan serviced by LoanMart, or dial 855-422-7412 to get in touch with a title loan representative! If you qualify for funding, you can access competitive interest rates and obtain emergency cash in as little as 24 hours.1 3

How Do Auto Title Loans Affect Your Credit?

When you sign a loan contract, you agree to the terms written by the lender in the agreement. Defaulting on your title loan is considered a breach of contract, and that usually has serious consequences – which can include reporting of your late payments to the credit bureau.

One of the potential consequences of defaulting on your title loan is vehicle repossession, which can leave a negative mark on your credit report for seven years. If you want to avoid the potential consequences of loan default, it is important to do your due diligence and create a budget that prioritizes your monthly payments. It is generally recommended to set up automatic payments from your bank account so you can stay on top of your installments each month! But don’t hesitate to contact your lender or loan servicer if you’re struggling with your loan payments. If you properly communicate your financial hardship before you default on your loan, you can discuss your options with your lender and try to refinance your existing title loan to potentially obtain different loan terms!1

Do you have questions about car title loans affecting your credit? Talk to a LoanMart title loan agent today at 855-422-7412! One of the perks of applying for a title loan serviced by LoanMart is that title loan representatives are available six days a week for extended hours to answer your questions and take your call!

What is the Maximum Amount You Can Borrow on a Car Title Loan?

Depending on the applicable lending laws in your state, your vehicle’s value, and your income, you could potentially receive up to $15,000 if you are eligible for a title loan!1

Dial 855-422-7412 or click here if you’re curious about how much money you could get through an auto title loan serviced by LoanMart.1

Where Can I Apply for a Title Loan Online?

Now that you know how title loans work, you may want to know more about the application process for a title loan! Fortunately, if you are applying for an auto title loan serviced by LoanMart, you can start your title loan application from the comfort of your home using your smartphone, laptop, or computer.1

Take a closer look at the three basic steps you must complete to receive emergency cash through a car title loan serviced by LoanMart:1 3

- Apply Online or Over the Phone: You have two options to begin your loan application for a title loan serviced by LoanMart. You can submit a brief inquiry form online or dial 855-422-7412 to speak directly to a trained title loan agent.

- Submit Your Documents: If you receive initial approval for a title loan, you must submit the required documents so they can be verified for completeness.

- Find Out if You Qualify for Emergency Funding: If you are eligible for a title loan and sign your electronic contract, you can choose between one of the following ways to collect your loan proceeds:1

- Direct Deposit to Your Bank Account

- A Check in the Mail

- Pick Up Your Cash at Any Participating Money Transfer Location Near You

Find out if your vehicle and income are eligible for the money you need to handle your financial issues! If you qualify for a title loan serviced by LoanMart, you can access quick funding in as little as 24 hours! Click here or dial 855-422-7412 to apply for a title loan today.1 3

Getting a title loan is easy!

We have streamlined the process to ensure your title loan experience is fast and enjoyable. The whole process is only 3 steps and we can have money in your hands as fast as today! A car title loan is easy to qualify for because you are using the money you have already put in your vehicle to secure a loan today.