Find LoanMart Title Loan Locations Across the United States

Looking to apply for a title loan near you? LoanMart’s title loan locations can be closer than you think! When you’re ready to apply for a title loan serviced by LoanMart, review this list below to see if a car title loan is available in your state:1

Title Cash Locations Near Me

Whether you live in a big city or a small town, if you live in one of the previously mentioned states, you can apply for a title loan serviced by LoanMart today! It’s never been easier to find out if you can unlock emergency cash with your car’s title through an auto title loan.1

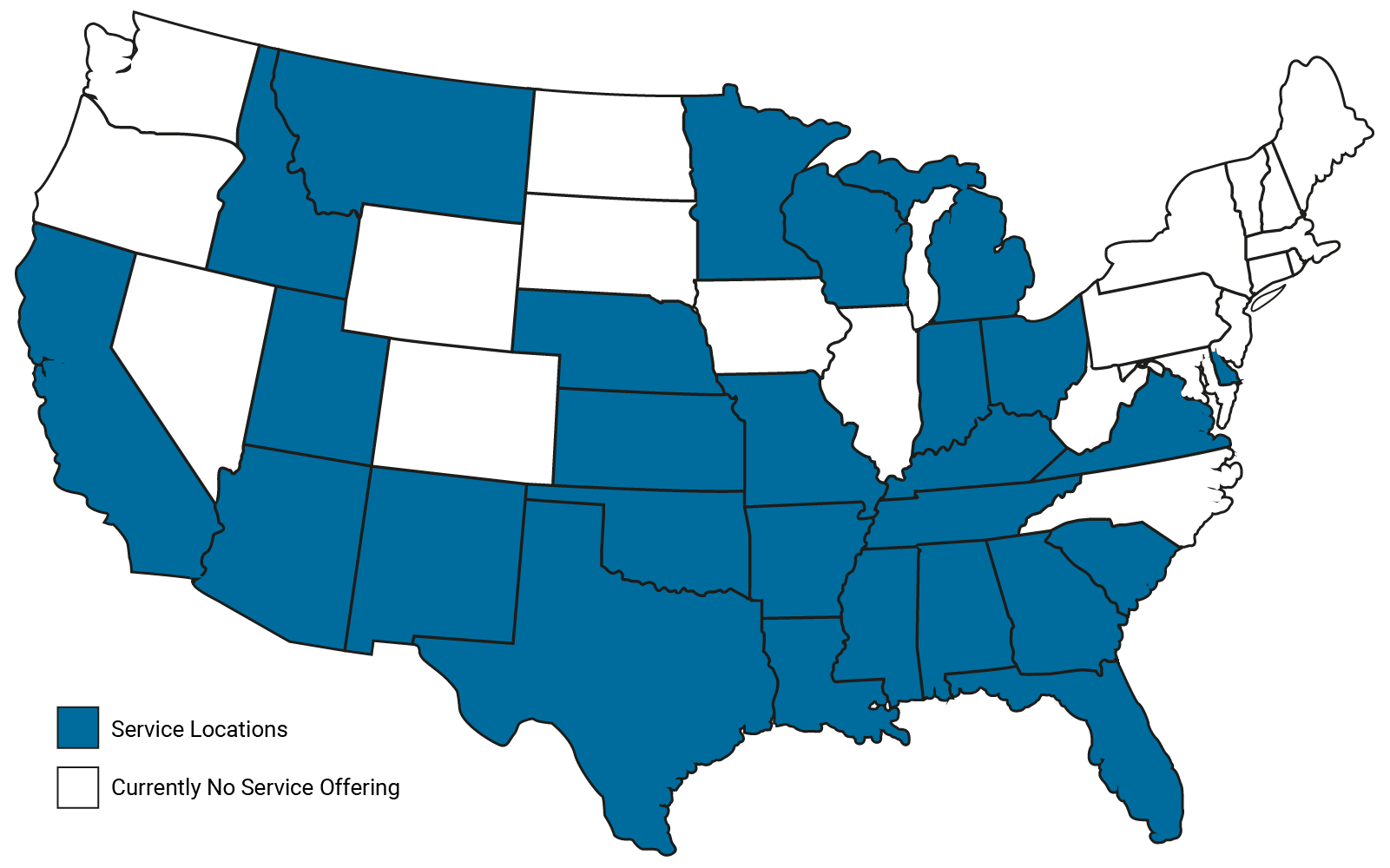

Ready to apply for a car title loan? Finding the nearest title cash location can be simple! Check out the map below to learn more about the available LoanMart title loan locations:

Check out the states we service below:

To find out if you are eligible for a car title loan in your state, you can conveniently call 855-422-7412 to speak to a LoanMart title loan agent today and see if you can apply for the emergency cash you need! Or, click here to apply for a title loan online and find out if you are eligible for instant pre-approval today.1 3

How Can I Get Cash for a Car Title Near Me?

If you’re in a tough financial situation and need fast cash to pay for an unexpected bill or expense, a title loan serviced by LoanMart could be the solution! Title loans are secured loans that can allow you to borrow against the available equity in your vehicle.1 Before you submit a loan application at a title loan loan place near you or online, understanding how title loans work is crucial if you want to make an informed decision.

If you live in one of the serviced states, title loans can be a convenient way to access emergency funding – here’s how to do it:

Meet the requirements

You must meet the initial requirements and be ready to use your car’s title as collateral in order to guarantee the loan. During the term of the loan, you will be able to maintain access to your vehicle while you make your monthly payments on time!

Apply and get approved

To get started, simply fill out a short online application and see if you qualify for same day pre-approval.1 3 Upon initial approval for a title loan, you will be asked to provide a few documents besides the title of your car, like a picture ID and proof of income. These documents are used to verify your application information!

Sign the loan agreement and get funds

One your documents are verified, you can choose how you want to receive your loan proceeds. Once you’ve had a chance to thoroughly review your loan agreement, sign it and send in your vehicle title to get your loan finalized! With auto title loans serviced by LoanMart, eligible borrowers can receive their funds in as little as one business day.1 3

If you have any questions about applying for a title loan, our title loan representatives are available 6 days a week, so call 855-422-7412 today, or visit our FAQ page to learn more about the application process!

Where Can I Apply For Title Loans Near Me?

If you are looking for the best place to get a title loan near you, the nearest place might be your own home! With title loans serviced by LoanMart, you can conveniently apply online and access a flexible application process without having to visit a loan store!1

If you live in one of the states that LoanMart services, you won’t need to visit a storefront location to apply for the financial help you need. Instead, you can conveniently fill out a quick inquiry form online or call 855-422-7412 to apply for a title loan serviced by LoanMart! Qualified borrowers can expect to receive competitive interest rates, no prepayment penalties, and zero hidden fees.1 3 5