How Do Title Loans Work in Warren?

Car title loans in Warren work by helping a qualified borrower access a portion of their vehicle’s value. To get approved for a title loan, an applicant must use their car’s title as collateral for the loan. Since collateral is required to guarantee the loan and access fast funding, you can expect a much more flexible application process compared to many traditional bank loans. A bank account isn’t required to get your money, and you can receive your loan proceeds in as little as 24 hours if you’re eligible!1 3

Getting a loan against your car can be a convenient way to access emergency cash when you need to take care of unexpected expenses or another financial emergency. If your application is approved and you sign your loan agreement, a title lender will place a lien on your vehicle’s title once the funds are disbursed. The lien is released after you have made your final loan payment, and one of the many perks of vehicle-secured loans is that you’re allowed to continue driving your car throughout the repayment period.

To qualify for an online car title loan in Warren, you must meet a few requirements during your application, including the criteria listed below:

- Have an Ohio-Issued Car Title in Your Name

- Be at Least 18 Years Old to Apply for a Warren Title Loan

- Have a Vehicle with a Decent Amount of Positive Equity

- Provide Proof of Your Ability to Make Title Loan Payments

Whether you have a Chevrolet Malibu, Toyota Prius, or another qualifying vehicle, you can borrow against its value and get emergency cash if you meet the lender’s requirements for a title loan!1 With an online title loan serviced by LoanMart, you can choose from a few different options to get your funding, including a direct deposit to your bank account or a check sent to your Warren address.

Do car title loans in Warren, OH, sound like the right fit to deal with your financial situation? Don’t hesitate to call 855-422-7412 to speak directly with a LoanMart title loan agent and learn more about the application process! If you prefer to start your application online, complete a short questionnaire and instantly find out if you are prequalified.1

How Much Can You Get Through Car Title Loans in Warren?

The loan amount you can access through a car title loan is primarily determined by the value of your vehicle, along with another important factor, which is your ability to pay the loan. The more your vehicle is worth, the more you can access through an auto title loan in Warren if you qualify! However, to get a larger loan amount, you must be able to prove that you can make payments on your title loan. Depending on the value of your car and your current income, you can borrow up to half or more of your car’s equity through an online title loan!1

The average loan amount for a title loan in Ohio serviced by LoanMart is $4,224. Use LoanMart’s online calculator tool at your convenience to receive a personalized title loan quote with no obligation.1 Enter a few basic details about yourself and your car into the online form:

- The Year of Your Car, Truck, or SUV

- The Make, Model, and Style of Your Vehicle

- The Current Mileage Listed on Your Vehicle’s Odometer Reading

- Your Current State of Residence (Ohio)

Discover how much money you can qualify for through car title loans in Warren! If you receive full approval, you can access your emergency cash in as little as 24 hours and use your title loan funds to manage various personal expenses, including car repairs, rent payments, or urgent medical costs.1 3

What is the Process for Getting Personal Title Loans in Warren, OH?

The application process for a personal title loan can be simple, no matter where you are located in Ohio. With a car title loan serviced by LoanMart, there are just three streamlined steps involved with applying for the cash you need:1

- Choose How to Apply: Start your application online or speak to a title loan agent today by calling 855-422-7412 and find out if you’re pre-approved for an auto title loan serviced by LoanMart.1

- Provide Documentation: If you are prequalified for a car title loan, the next step is to submit several documents to verify your information and vehicle ownership. Although the list of required paperwork can vary by state, you can expect to provide the title of your car, proof of income and address, photos of your vehicle, and a valid, government-issued photo ID card, regardless of whether you’re applying from Warren or nearby cities, such as Youngstown and Akron.

- Get Your Money: If you receive full approval, you can decide how to get your money and sign your loan agreement!1 Unlike payday loans in Warren, you don’t need an active bank account to qualify for a title loan. If you don’t have a bank account, you can choose between getting a check in the mail or picking up your funds at any participating money transfer location in Warren. Borrowers with bank accounts can receive the loan proceeds via direct deposit in as little as one business day!3

Got any questions about applying for auto title loans in Warren? LoanMart title loan officers are available six days a week for extended hours to take your call. Dial 855-422-7412 to learn more about car title loans and the flexible application process today! Qualified borrowers can take advantage of perks like competitive interest rates, zero prepayment penalties, and fast funding.5

Can I Get Online Title Loans in Warren Without a Job?

While you must submit proof of income during your loan request, you don’t necessarily need a job or a traditional career to get an auto title loan online. If you don’t receive regular pay stubs, an alternative option is to provide other qualifying documentation, such as bank statements or benefits letters. If you’re one of the 6.5 million drivers who work for Uber, for example, you can submit recent bank statements to prove you’re capable of handling your title loan payments.

When applying for an online car title loan in Warren, the two most important factors that will determine your eligibility for funding are your income and your vehicle’s value. If you want to strengthen your chances of getting approved, you can try applying for a title loan with a co-signer who has a steady source of income and a better credit profile. Call a title loan representative at 855-422-7412 to find out if your current source of income can be used to verify your ability to make payments on a Warren title loan.1

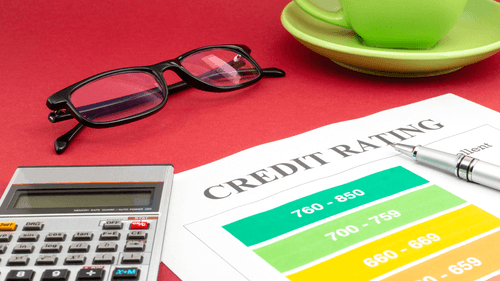

What is the Minimum Credit Score for Auto Title Loans in Warren, Ohio?

Qualifying for unsecured loans or other forms of credit can be difficult when you have a bad credit score. If you need quick cash to cover sudden expenses, you may find it discouraging to apply for a traditional bank loan if your credit score has taken a hit due to your financial situation. Thankfully, auto title loans in Warren, Ohio, can cater to applicants with poor credit scores. The minimum credit score required to get a title loan will typically vary from lender to lender, but some car title loan lenders don’t have any minimum credit score requirements!

You don’t need to have a good credit history to get approved for an online title loan.1 As mentioned previously, your car’s value and your income are the main factors that will determine your eligibility for title loan funding. Even if you have bad credit, you can still qualify for quick cash if your vehicle has sufficient equity and you provide proof of your ability to make title loan payments. In addition to the flexibility of the application process, you can expect other valuable benefits if you are eligible for a car title loan serviced by LoanMart in Warren:1

- Outstanding Customer Service

- Flexible Loan Terms

- Freedom to Spend Your Cash as You See Fit

- Convenient Customer Web Portal

- Keep Driving Your Car While You Make Payments on the Loan

If you’re struggling with a financial emergency, why wait to apply for the funds you need? Apply for car title loans in Warren serviced by LoanMart by filling out a quick online form or dialing 855-422-7412 to speak with a title loan officer! Both options can be streamlined for your convenience.

Addresses shown display closest MoneyGram locations. Map displays all MoneyGram locations in general vicinity.

Locations Near Warren, Ohio

LoanMart is proud to help people all over the United States, including Warren, Ohio and beyond! Look through the different LoanMart service areas and see which one is closest to your neighborhood:

Nearby States by Ohio That Offer A Title Loan Serviced by LoanMart

LoanMart is proud to help people all over the United States, including Warren, Ohio and beyond! Look through the different LoanMart service areas and see which one is closest to your neighborhood: