Table of Contents

Maria had heard about car title loans, and thought she could use one to cover an unexpected medical bill. After all, such loans have helped scores of consumers nationwide with financial emergencies. Choosing an online title loan platform that guaranteed fast approval and very low interest rates, she handed over personal details and vehicle information. Unfortunately, she fell victim to a scam. The fraudulent “lender” drained her bank account and disappeared, leaving her finances in turmoil.

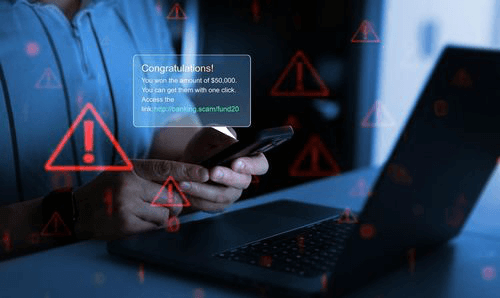

Sadly, stories like Maria’s are becoming increasingly common as title loan scams proliferate across digital platforms, driven by a surge in online lending. Learning how to spot and avoid title loan scams is essential to protecting your personal information and financial stability. Here’s what you should know to protect yourself from title loan fraud.

What is a Title Loan?

A title loan is a type of secured loan where the borrower uses their vehicle’s equity as collateral to get cash for personal or household expenses. With title loans serviced by LoanMart, the loan amount offered is based on the car’s value and ability to pay the loan back.1 The amount customers can borrow is up to them, as long as it’s within the approved loan range.

What are the Key Requirements for a Title Loan?

In order to qualify for an auto title loan serviced by LoanMart, customers are required to own a vehicle, with its title in their names. Borrowers must also prove they have reliable sources of income to pay the loans off. They also must have government-issued photo IDs and proof of their addresses, such as utility bills or a similar document.

How Do Title Loans Work?

In order to apply for a title loan, customers fill out short loan applications – either completely online or at a title loan store. If approved, a borrower receives the money and retains possession of the vehicle. A lien is placed against the title until the borrower repays the loan as agreed upon in the loan contact. If the customer does not repay the loan as agreed, the lender can ultimately recover and sell the vehicle.

Why are Title Loans Popular?

Auto equity loans can provide fast access to cash. This can be crucial for a financial emergency such as a medical bill or a badly leaking roof. Loans serviced by LoanMart are typically funded in just one business day, and sometimes even sooner.1 3

Many LoanMart customers also appreciate that, unlike traditional banks, the focus to determine loan eligibility is on a borrowers’ income rather than their credit score or past credit challenges.

Also, where pawn title loans may require borrowers to turn over their vehicles, car equity loan borrowers can continue driving their vehicles, as long as their accounts are in good standing.

Call Our Team

Take the first step and call our toll-free hotline to speak with a specialist.

The Rise of Title Loan Scams in the Digital Age

Digital auto equity loan scams are proliferating, and becoming more sophisticated, as scammers take advantage of an increase in digital options for financial solutions. According to research by McAfee Labs, personal finance scams surged nearly 150% from May 2025 to late July.

Ease of Creating Fake Title Loan Websites

It requires minimal technical skill to set up a website pretending to offer auto title loans, allowing bad actors to appear as legitimate lenders and collect personal and financial information under pretenses.

Fake websites can mimic legitimate lenders, making it difficult for vulnerable borrowers to distinguish authentic sources such as title loans serviced by LoanMart from title loan scams online. Scammers are also using new technology, such as AI, to enhance their tactics.

Targeting Vulnerable Borrowers Online

Predatory lenders actively target consumers who are, due to low income, job loss, or poor credit, more likely to take out a title loan out of desperation.

Digital tactics include advertising in underserved and low-income communities, aggressive online marketing, and deceptive terms that make it difficult for borrowers to understand loan risks and true costs.

With those facts in mind, here’s what to watch out for and how to avoid title loan scams online.

Online Title Loan Red Flags

Nefarious title loan lenders trick borrowers in a variety of ways. Signs of a title loan scam include lenders that:

- Guarantee approval

- Require payment before loan approval

- Pressure customers to act immediately

- Use generic email addresses rather than company domains

- Operate without verified business addresses

Signs of a Fake Online Title Loan Website

Details that can indicate fraudulent websites and websites that act like they are a lender even though they are not:

- No secure HTTPS connection

- Grammar and spelling errors

- No privacy policy

- Vague or confusing repayment terms

- Disclosures that specify that the website is not a lender

Common Online Title Loan Scams to Avoid

To help you protect your finances and your peace of mind, here are some of the common title loan scams you may encounter online and should look out for.

- Upfront Fee Scams

A common scheme involves requiring the borrower to pay certain fees in advance. But after the payment is made, the so-called online lender disappears or stops responding. Legitimate title loan options such as title loans serviced by LoanMart will never require customers to pay a fee before funding their loans, and the loan terms are both simple and transparent. - Unrealistic Interest Rates

Title loans serviced by LoanMart have competitive interest rates that are typically lower than those attached to payday loans. Consumers should be wary, though, of online lenders who offer a rate that’s way under the market average. If the proposed interest rate looks too good to be true, it probably is. Fake lenders may do so to lure victims, only to capture their personal details to engage in identity theft. - High-Pressure Online Sales Tactics

Urgency is fake lenders’ currency. Scammers may warn customers that their offer expires in hours or that their approval will be revoked if they don’t immediately submit a payment. A reputable and trustworthy title lender will give customers time to read the loan terms and make informed decisions. At LoanMart, our customer service agents are happy to answer any questions about terms, requirements, or the loan process. - Bait-and-Switch Loan Schemes

Auto equity loan borrowers should be on the lookout for bait-and-switch schemes where final loan contracts differ markedly from advertised offers. One Reddit user described a recent scam involving a seemingly legitimate online title company. After applying, the customer was contacted by “brokers” with conflicting details and the user later found out the company’s address was fake.

Steps to Protect Yourself from Online Title Loan Fraud

The following measures can help you protect yourself from online lending scams.

- Verify the licenses of the lender

- Verify lender legitimacy through the Better Business Bureau (BBB) and other reputable online reputation platforms

- Read all loan terms carefully before signing an agreement

- Look for a physical address for the lender online

- Check for secure website connections

- Never pay fees up front

- Be wary of any unsolicited title loan offer received online

- Avoid sharing sensitive personal information on unsecured sites

While online title lending platforms can be convenient, it’s crucial to exercise caution before taking out a loan. Again, if a title loan offer sounds too good to be true, it probably is. Stick with trusted, reputable, established loan servicers such as LoanMart, which has been in business for more than 20 years. We pride ourselves on transparency and excellent customer service and support.

Apply today for a title loan serviced by LoanMart!