Table of Contents

- What is Cash 1?

- How Does the Application Process for Cash One Loans Work?

- Can I Get Installment Loans like Cash 1 with No Credit Check?

- How Do Title Loans Serviced by LoanMart Compare to Cash 1 Loans?

- What to Expect with the Loan Terms for Cash 1 Loans

- Can I Refinance a Cash One Loan with a Car Title Loan Serviced by LoanMart?

What is Cash 1?

Cash 1 is a short-term lending company established in 1997 that offers different financial services for people needing emergency cash, including installment loans, personal loans, title loans, and lines of credit. Headquartered in Phoenix, Arizona, Cash 1 primarily focuses on providing convenient and accessible solutions to individuals who may not qualify for traditional bank loans or other types of installment loans.

This loan company is only available in 7 states (Arizona, Nevada, Utah, Idaho, Missouri, Kansas, and Louisiana), and is a Better Business Bureau (BBB) accredited company with a B rating as of May 2025. It’s worth mentioning that not all of Cash 1’s financial products are available in the aforementioned states. If you want to get a car title loan, for example, you will only have the opportunity to apply for this loan option if you live in Arizona or Nevada. Continue reading to learn more about this lending company and discover if other loans like Cash 1 can be a better alternative.

Call Our Team

Take the first step and call our toll-free hotline to speak with a specialist.

How Does the Application Process for Cash One Loans Work?

The Cash 1 application process for their loan products is generally streamlined and can be completed virtually or in person at one of their store branches in Arizona and Nevada. Whichever loan product you decide to apply for, you can expect to find the same convenient application process to get quick funding, although some of their services may have some variations.

For example, during the application for a line of credit, you can review the total amount you are eligible for and decide to withdraw all of it at once (up to your available credit limit) or a smaller portion for the time being. And with an auto title loan, you are typically required to complete a vehicle inspection at one of Cash 1’s storefront locations during the second step of your loan request.

However, besides those two instances, you will find that Cash One loans often have the same basic application steps. If you’re interested in applying for one of the applicable financial products and you live in one of the states the company operates in, you can anticipate the application process to look like this:

- Start Your Application: To begin your loan request, you must fill out an application form and provide your personal information, such as your name, address, and income.

- Receive Pre-Approval: After you’ve submitted your personal details, Cash 1 claims you will receive instant pre-approval with the loan amount you qualify for if you meet their eligibility criteria for the financial product. Assuming you want to proceed, the next step is to sign your loan agreement, provide your payment information, and move on to the final step in the application process. If you’re applying for a car title loan, you must prove you’re the rightful owner of your vehicle by providing a car title in your name as collateral for the loan.

- Get Your Funds: If you decide to sign your loan contract and get a loan from Cash 1, you can receive your money in your bank account via direct deposit. Applicants who prefer another method to receive funding will only have the alternative of visiting one of Cash 1’s physical locations to pick up their cash.

Keep in mind that the requirements for a Cash One loan typically consist of being 18 years of age or older, submitting proof of income, and having an open checking account. However, you may also have to provide your Social Security Number when applying for a Cash One loan virtually or over the phone.

Can I Get Installment Loans like Cash 1 with No Credit Check?

Are you searching for loans like Cash 1 but have bad credit? Many lenders review an applicant’s credit history to determine their creditworthiness and their ability to make a monthly installment. If you’re looking for no credit check title loans or any other Cash 1 loan without the lender reviewing your credit history, you may be out of luck. But, Cash 1 Loans claims to offer a “proprietary” underwriting process to assess the borrower’s creditworthiness. While Cash 1 claims to work with applicants with less-than-perfect credit, some recent customer complaints seem to prove otherwise.

How Do Title Loans Serviced by LoanMart Compare to Cash 1 Loans?

If you’re unsure about getting funds through Cash 1, you may wonder how their loans compare to an auto title loan serviced by LoanMart. Review the important comparisons below to make a more informed choice when applying for a loan.

Where Can I Apply for Title Loans Serviced by LoanMart and Cash 1 Loans?

While Cash 1 offers some online loans, they are primarily a branch-based loan provider. As mentioned previously, if you want an auto title loan from Cash 1, you can only apply for funding in Arizona or Nevada, so there is limited availability in that regard. Thankfully, since LoanMart is an online marketer and loan servicer, you can apply for a title loan in many different states.1

What is the Application Process for Title Loans Serviced by LoanMart?

When applying for an auto title loan, you must typically complete a vehicle examination to qualify for funding, no matter which lender or loan servicer you choose to work with. However, a significant advantage of an online title loan serviced by LoanMart is that you don’t have to go anywhere to get your car’s value appraised! Unlike a Cash 1 title loan, where you are required to visit one of their offices to go through this process, you can simply upload photos of your car to complete a virtual appraisal during the application for a title loan serviced by LoanMart. It can be much simpler to apply for a vehicle-secured loan when you can do this important step from the comfort of your home.

What Does the Repayment Period Look Like for Title Loans Serviced by LoanMart?

Although these two loan options share similar benefits, like no prepayment penalties and quick application processes, you will find additional exclusive perks if you apply for a car title loan serviced by LoanMart.5 Not only can you begin your loan request online, but you can also anticipate flexible loan terms, convenient payment methods, zero hidden fees, and competitive interest rates.5 You won’t need an open checking account to qualify for an online title loan serviced by LoanMart, since that isn’t an application requirement. Qualified applicants can also encounter helpful customer service agents throughout the entire loan process.

Here’s a quick breakdown of how Cash 1 loans and auto title loans serviced by LoanMart compare to each other:

| Cash 1 Loans | LoanMart | |

Products | Installment Loans, Personal Loans, Title Loans, Lines of Credit | Car Title Loans |

States Serviced | Arizona, Idaho, Kansas, Louisiana, Nevada, Missouri, Utah | Alabama, Arizona, Arkansas, California, Delaware, Florida, Georgia, Idaho, Indiana, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Missouri, Montana, Nebraska, New Mexico, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Wisconsin |

Min and Max Loan Amount | $50-$50,000 | Minimum Loan Amount Can Vary by State. Maximum Loan Amount is $15,000, excluding California, which is $50,0001 |

| Mobile App | Yes | Yes |

Business Model | Primarily a Branch-Based Loan Provider, but Also Provides Loans Online or Over the Phone | Primarily Markets and Services Title Loans Online |

What to Expect with the Loan Terms for Cash 1 Loans

The terms for Cash 1 Loans may vary based on state regulations, your credit profile, and the financial product you choose. Below is a general overview of what you can expect during the repayment process:

| Loan Product | Collateral Required | Term Length | Interest Rates |

Title Loans | Yes – your vehicle title | Usually 30 days to a few months | Higher APRs than traditional bank loans |

Line of Credit | No (unsecured) | Open-ended, as long as you meet the repayment terms | Varies by state and credit profile; generally lower than payday loans |

Installment Loans | Usually no | 6 to 24 months | High but predictable; APR varies by state |

Personal Loans | No (unsecured) | 3 to 24 months | High APRs compared to bank loans, but often lower than title / payday loans |

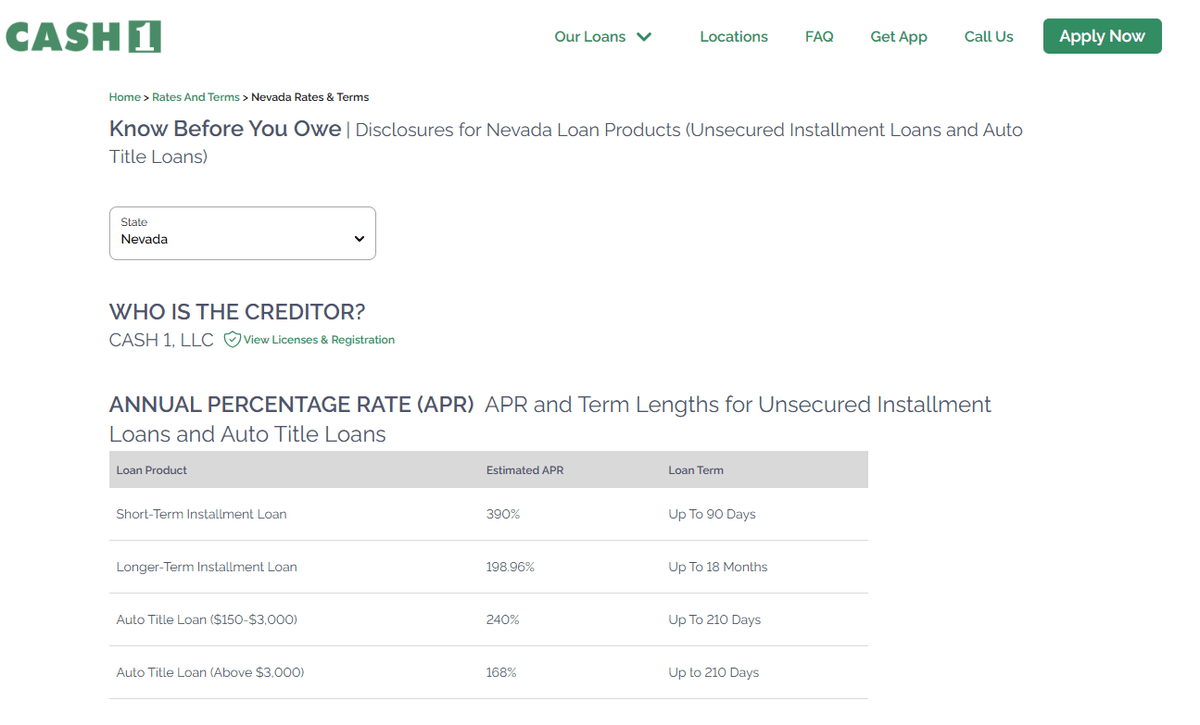

Loan Terms for Nevada advertised by Cash1 as of May 2025:

Can I Refinance a Cash One Loan with a Car Title Loan Serviced by LoanMart?

Are you currently paying for a Cash One loan? If you are unsatisfied with your current loan terms and want a different option, you can apply to refinance your Cash One loan with a car title loan serviced by LoanMart!1 Submit a prequalification form online or over the phone, provide the necessary documentation, and sign your new loan contract if you qualify!1 If you receive full approval, a portion of your loan amount will go to paying off the current balance of your loan with Cash 1, and you can use the rest of the available funds to handle different personal expenses.

Apply for an auto title loan serviced by LoanMart if you’re interested in refinancing your Cash 1 loan or if you are simply looking for a convenient way to get fast cash. Through a vehicle-secured loan, you can expect to get your money in as little as 24 hours if you’re eligible for funding!3 Visit our FAQ page or call 855-422-7412 for more information about online car title loans serviced by LoanMart.