Table of Contents

Let’s say you’ve had money problems which led to a notable drop in your credit score. Or maybe there’s an error on your credit report that’s keeping your score deflated. Either way, you want to improve your credit to unlock better financial opportunities, save money when borrowing and enhance your peace of mind. Pondering this has probably left you wondering, “How long does it take to remove bad credit information from my credit report?” Here’s what you need to know.

About Credit Reports and Credit Scores

Credit reports are detailed summaries of your credit history compiled by the major credit bureaus – Experian, Equifax and TransUnion. These companies chronicle your payment history, loan balances, credit limits and the dates your accounts were opened and closed, based on reports they get from lenders, loan servicers and other data furnishers. Your credit reports also have sections covering lender inquiries about your creditworthiness, along with any collections, bankruptcies and other related public records you may have accrued. In short, your credit reports track how you’ve managed debt and form the basis for your credit scores.

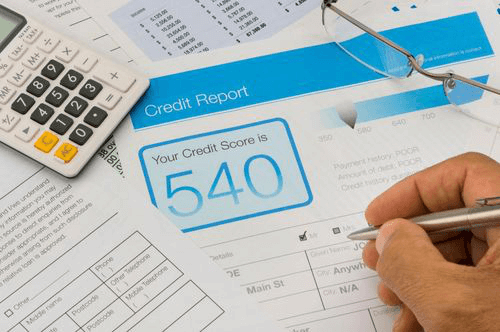

What are credit scores?

Credit scores are three-digit numbers that rank your creditworthiness. We’re saying scores – plural – because they are calculated separately by each of the three credit reporting bureaus, and because there are different credit score versions, also known as “models”. Credit score models that are widely used include those developed by the Fair Isaac Corporation (i.e. the FICO® Score), and models developed by the credit bureaus themselves (the so-called VantageScore®). Both FICO and Vantage have several versions, including industry-specific ones and versions that are revised over time.

Depending on their industry and preference, lenders use one or several of these models to assess the degree of risk you represent as a borrower and set the interest rates you’ll be asked to pay for loans accordingly – should they decide to lend to you.

In addition to loans, your credit scores can affect your ability to rent apartments and get services such as utilities. Credit scores also figure into your insurance costs and employment prospects. Typically ranging from 300 to 850, the higher your scores the better.

Depending on the model and version, the scale breaks out approximately as follows:

Poor: 579 and below

Fair: 580-669

Good: 670-739

Very good: 740-799

Exceptional: 800 and above

These scores are calculated primarily based on your payment history (whether you pay bills on time) and credit utilization (how much debt you have relative to your credit limits). Additional factors include the length of your credit history, how many new credit accounts or inquiries you’ve had recently and your account type mix (revolving credit and installment loans, for example). Scores in the “good” range or better qualify you for favorable loan and credit card interest rates. Fair and poor scores can limit your loan options, subject you to higher interest rates and introduce additional fees.

How can I check my credit?

You can check your credit reports for free once per year at AnnualCreditReport.com. Reports from each of the “big three” credit reporting bureaus can be had this way. It’s a good idea to do so at least once a year to catch errors or potential fraud early. You may also want to check them more frequently, such as quarterly, particularly if you’re planning a significant purchase or you’ve had a data breach or experienced identity theft.

Duration of Negative Information on Credit Reports

So, how long do negative items stay on your credit reports? Most negative items remain on credit reports for seven years from the date of the first missed payment or delinquency that led to the entry. Under the Fair Credit Reporting Act these items are automatically removed from credit reports with no action required from you when their time runs out. Judgments can also linger for seven years, or until the statute of limitations expires – whichever is longer. Hard inquiries (lenders checking your credit to see if you qualify for a loan) remain on your reports for two years. Chapter 7 bankruptcies stay on your reports for 10 years. Chapter 13 bankruptcies generally remain for seven years.

Removing Negative Items from Your Credit Report

Contrary to widespread belief, you cannot remove negative items from your credit reports if they are accurate. With that said, the Federal Trade Commission offers guidance for disputing inaccuracies. Procedures include submitting disputes online, or by phone or certified mail to whichever credit bureau shows the error. Include your name, address, account details and a clear explanation of the issue. Add copies of any documentation you may have supporting your assertions. Credit bureaus generally have up to 30 days to investigate your dispute and notify you of their results. It is also a good idea to contact the creditor or lender that supplied the information directly. They are obliged to investigate and, if reported in error, update the credit bureaus. You may dispute multiple inaccuracies in a single submission.

Credit Repair Services

You can also use a credit repair service to dispute credit report errors. However it is important to be careful to choose a reputable company with a strong Better Business Bureau rating. Given the number of predatory operators in that area, it’s important to avoid firms that guarantee quick fixes or charge upfront fees. Legitimate credit repair companies do not engage in such practices. In all frankness though, you can do everything a credit repair service can do yourself in most cases.

Negotiating with Creditors

Contact your creditors early if you realize you’re about to miss payments. This approach can help prevent credit history damage and, if done proactively, aid your credit recovery. Propose options such as waived fees, lower interest, lower payments or lump-sum settlements, based on what you know can afford to do. Get any agreements you reach in writing. Creditors can sometimes be persuaded to remove negative items from your credit reports when you meet the terms of the deals – if you ask.

What to Expect After Item Removal?

After a credit bureau has removed a negative item from your report, your score will typically improve when their reports are refreshed. The extent of the improvement depends on factors such as your overall credit profile and the severity of the transgression. For example, a collection is considered more severe than a late payment. You should monitor your credit report to confirm the items removal and to watch for the rare – but possible – reinsertion of an item. File a dispute promptly if that happens.

Maintaining a Good Credit Score

It is important to do everything possible to maintain your standing by avoiding falling into destructive financial patterns once your reports are cleared up and your scores have improved. These tips will help you accomplish that goal.

- Pay bills on time. Payment history is the most significant factor of your credit scores, accounting for about 35% of their calculations. Establish automatic reminders or payments to avoid late fees and pay more than the minimum amount due whenever possible.

- Manage credit utilization. Keep balances below 30% of your total credit limit to show lenders you don’t over-rely on credit. Pay off your credit cards in full each month whenever possible and avoid maxing out your accounts. Note that closing accounts can increase your credit utilization percentage and decrease your score.

- Monitor and diversify credit. Review your credit reports routinely for errors and dispute inaccuracies immediately. Set up alerts for suspicious activity. Maintain a mix of credit types, but avoid opening and closing accounts unnecessarily.

Meanwhile, if credit problems are making it difficult for you to get cash for an emergency situation, consider applying for a car title loan serviced by LoanMart. Qualification is easy, even if your credit score has taken a few hits.1 Apply today to see how a car collateral loan serviced by LoanMart might help you!